Coinbase's IPO, how Greylock develops young partners, Tiger Global, and more.

Welcome to The Takeoff, a newsletter and podcast helping students and young professionals learn more about startups, tech, venture capital, and more. In this newsletter, we share content that our team found worthwhile over the past two weeks. If you enjoy the content, please subscribe below, share it with friends, and give us a like by hitting the ❤️ button!

Hey everyone,

Michael here 👋. Welcome to the April 24th Edition of What We’ve Been Following. We cover a lot of great content in here, so I hope you get a chance to check out some of it in-depth over the weekend.

New content since the last What We’ve Been Following newsletter from April 11.

(Podcast) Lukas chatted with Seth Winterroth (Partner at Eclipse Ventures) to discuss his background, mentorship, and more.

(Clubhouse) We hosted a Clubhouse room with Opendoor co-founder and Atomic GP JD Ross the other day. We had an awesome convo about Opendoor, Atomic, how to spend your time early in your career, mentorship, and more. Unfortunately, we weren’t able to record the discussion given it was on Clubhouse, but stay on the lookout for more Clubhouse rooms in the coming weeks. We also recently made a club for The Takeoff on Clubhouse. You can join it by visiting the link below.

What we’ve been following.

Top 3.

(Blog / Newsletter) Easily my favorite piece of content from the past two weeks. Everett Randle (Principal at Founders Fund) put together a super well-written post highlighting the influx in startup investing by crossover funds such as Tiger, Coatue, Addition, and D1, among others. It’s a fairly long read, but if you’re interested in learning more about what these funds (like Tiger) have been doing re: venture investing (mainly, the sheer velocity and # of deals they are doing), I highly recommend giving the piece a read in its entirety.

(Podcast) Greylock GP David Sze joined Harry Stebbings on Twenty Minute VC to talk about learnings from working with Mark Zuckerberg and Reid Hoffman, the influx in pre-emptive rounds, and more. My favorite discussion in the episode has to do with how Greylock sets up its younger partners / team members for success well into the future, thus enabling the firm to succeed, too.

(Podcast) Ali Tamaseb (Investor at DCVC and author of Super Founders) joined Erik Torenberg to discuss his book, Super Founders, and some of his key takeaways / findings from the process of putting together the book. Ali explored a wide range of data points from over 200 unicorns to find common patterns / similarities across unicorns to determine what data can be used to suggest whether or not a company will become a unicorn. Working on side projects (aka The Takeoff) is strongly associated with someone starting a unicorn — hype!

The Rest.

(Blog) The Emerging Architectures for Modern Data Infrastructure (a16z).

(IPO) Coinbase went public last week in the biggest direct listing ever (I think Roblox is now the second-largest). Congrats to Brian Armstrong and the entire team at Coinbase on this milestone! I know there’s much, much more to come from them in the future.

(Video) Speaking of Coinbase, here’s Coinbase founder & CEO Brian Armstrong practicing his YC Demo Day pitch.

(Podcast) Barry Diller on Masters of Scale with Reid Hoffman discussing being an Infinite Learner and Learning to Unlearn.

(Podcast) Mike Maples (Floodgate) on The Knowledge Project with Shane Parrish from March 2020. Great episode on the mental models Mike uses and how he “lives in the future.”

(Blog) Gaby Goldberg put together a great report and post about Stanford’s relationship with VC and Sand Hill Road.

(Upcoming Event) Meet our Fund. Roshan flagged this, and I haven’t had the time to check it out in-depth yet, but it looks cool.

(Article) More about Tiger Global.

(New Fund) Index recently launched Index Origin to focus on seed-stage investing. Learn more here.

(Resource) Lenny Rachitsky launched a job board focused on product, design, growth, and engineering roles.

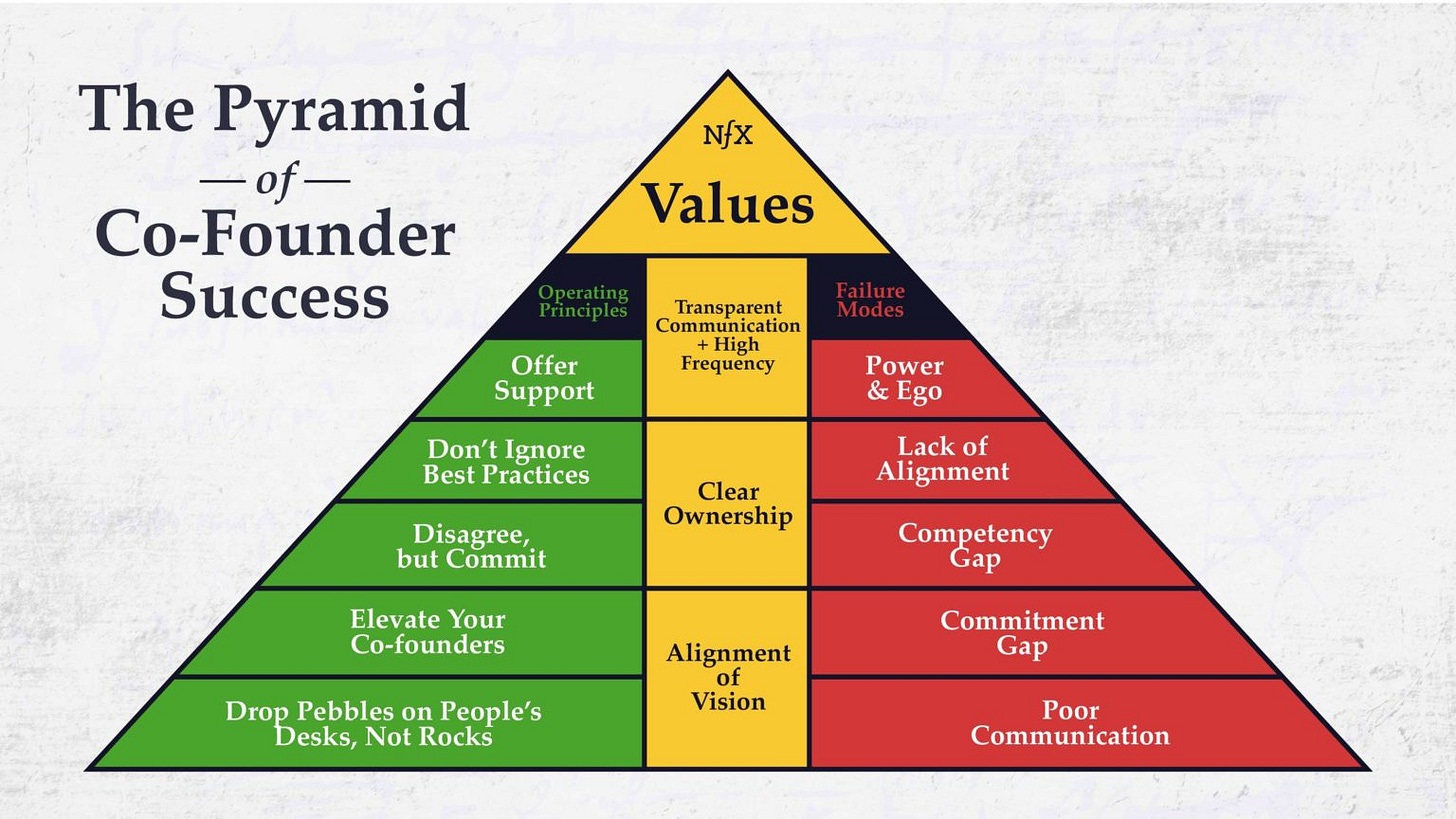

(Other) Cool graph from NFX showing “The Pyramid of Co-Founder Success.” Full blog post is here.

Funding 💲

Overtime raised $80m earlier this week from a stacked list of investors including Jeff Bezos, Drake, and a number of other athletes and investors.

Product management software Productboard raised a $72m Series C from Tiger, Index, KP, Sequoia, and Bessemer.

Locals raised a $3.8m seed round from David Sacks and Craft, Naval, Joe Lonsdale, and a number of others to help empower content creators.

AfterShip, an e-commerce tracking platform, raised $66m from Tiger Global.

ContentFly raised a Series A.

Did we miss any good content, venture rounds, and job postings from the past two weeks? If so, let us know on Twitter.

Written by Michael Spiro (Founder at The Takeoff. Senior at Washington University in St. Louis. JMI Equity, Equal Ventures, Ground Up Ventures, Intello).