Hey everyone,

Shekar Ramaswamy, a good friend of The Takeoff team, recently started a web3 newsletter: Coinsights. He covers topics ranging from the privacy implications of the blockchain to practical step-by-step guides on how to stake $SOL. Today on The Takeoff we are releasing “Liquidity is All You Need”, originally published on Coinsights, which I had the privilege of contributing to. If you enjoy today’s article, please consider subscribing to Coinsights to read more crypto content.

Welcome back to Coinsights! It’s been a while, but I’m excited to announce some exciting developments over the next few weeks. Stay tuned!

Today, I’ll be talking about one of the key components of the web3 ecosystem: exchanges. I recommend checking this article out on a large screen if you can, but it’s nbd either ways.

You’ve probably heard of the Nasdaq, a U.S. based exchange that enables people to buy and sell stocks. Exchanges are the backbone of any economy – at its core, an exchange is simply a system that allows entities to swap assets. If you squint hard enough, you can see how even your local grocery store is an exchange! Exchanges are the gas that keeps the economic engine humming.

Looking at web3, there are currently 10,000 cryptocurrencies! Plus, it’s increasingly trivial to create a new one in just a few hours. Therefore, it’s no surprise that the web3 ecosystem has its own set of exchanges that enable millions of crypto users to trade their coins and to keep up with the breakneck pace of innovation in the crypto world.

It’s clear that exchanges are a crucial piece of the web3 puzzle. So how do they work? Who are the major players in the space? What will make one more likely to succeed over another? Read on to find out!

Liquidity Is Everything

The most important concept in understanding exchanges is liquidity. From the all-knowing Investopedia:

Liquidity refers to the efficiency or ease with which an asset or security can be converted into ready cash without affecting its market price. The most liquid asset of all is cash itself.

Let’s break this down into two parts. First, “the ease with which an asset can be converted into cash.” This part relates to an asset’s volume, which measures how much of an asset is traded during a certain time period. An asset with a lot of aggregate value moving between entities in a short period of time is a high volume asset.

More nuanced is an asset’s float, which traditionally refers to the number of shares that exist on the open market. This relates to the second clause of the definition of liquidity: “without affecting its market price”. That is, the higher an asset’s float, the less likely it is that selling that asset will affect price. Said differently, when high float assets are sold, supply remains high, leaving the asset’s price relatively unaffected.

In short, high volume ensures that you can trade an asset when you want, and high float mitigates volatility. These two qualities define a liquid asset!

One of the most confusing aspects of liquidity is that people use it to describe both individual assets and exchanges. People will often say that both Bitcoin (a coin) and Uniswap (an exchange) are liquid. So which one is it? Well, it’s both. As I just outlined, an asset is liquid when it has high volume and float. However, the measure of an asset’s liquidity can also more accurately be considered in the context of the exchange it’s trading on.

For example, Coinbase is a popular exchange, and as a result, many people trade Bitcoin on it. Therefore, Bitcoin is liquid on Coinbase, and as a result Coinbase is also liquid. However, if I were to create Shekar’s Super Bitcoin Exchange, nobody would use it! So even though Bitcoin is generally liquid, it wouldn’t be liquid on Shekar’s Super Bitcoin Exchange, and therefore my exchange wouldn’t be liquid either.

High liquidity is crucial for a healthy exchange. Transacting with liquid assets on liquid exchanges ensures that you can trade when you want at (relatively) stable prices. As you can imagine, this is a highly desirable property for any asset (and any exchange)!

The Order Book Model

There are two prominent methods that exchanges use to facilitate transactions using liquidity. The first is the order book model. If you were to ask someone to explain how an exchange works, the order book model would likely be their first thought – buyers and sellers each list a price they are willing to transact at and there is a process that matches each side. The most popular stock exchanges today, such as the NYSE and the Nasdaq, use the order book model, and some crypto exchanges have adopted this method as well. In fact, you can even see the order book model in action on Coinbase Pro!

Centralized Exchanges

In the crypto world, exchanges that leverage the order book model are described as centralized because all trades flow through a single entity (aka a “middleman”). Many of the most popular exchanges are centralized, like Coinbase and Binance. Furthermore, centralized exchanges store your private keys and therefore manage your coins for you. Strictly speaking, you don’t own the crypto you see on your Coinbase account – Coinbase does! In reality, you trust Coinbase to give you the crypto that you own (or the cash equivalent) when you ask for it.

If your “wait a minute this is web3 shouldn’t things be decentralized and hmm how come I don’t own my own crypto” alarm is going off, good! Centralized exchanges aren’t a “pure” web3 product – I’d argue that they’re more web2.5. However, it’s important not to write off the notion of centralized exchanges altogether. They are a comfortable first step for people diving into the world of crypto, and tend to support common features that we’ve come to expect for financial products in web2 like reliable customer support, insurance, and strict regulation.

The existence of centralized exchanges implies the existence of decentralized exchanges. But before we get there, let’s learn about the underlying tech: Liquidity Pools & Automated Market Makers.

The Underpinnings of Decentralized Exchanges

A liquidity pool is a market for a specific pair of assets and the associated price ratio. However, instead of a centralized exchange matching specific buy and sell orders, a set of smart contracts govern the market instead. Liquidity pools can be created for any pair of assets, such as ETH & USDT. True to the web3 ethos, anybody can provide liquidity and subsequently earn rewards (more on these rewards later!).

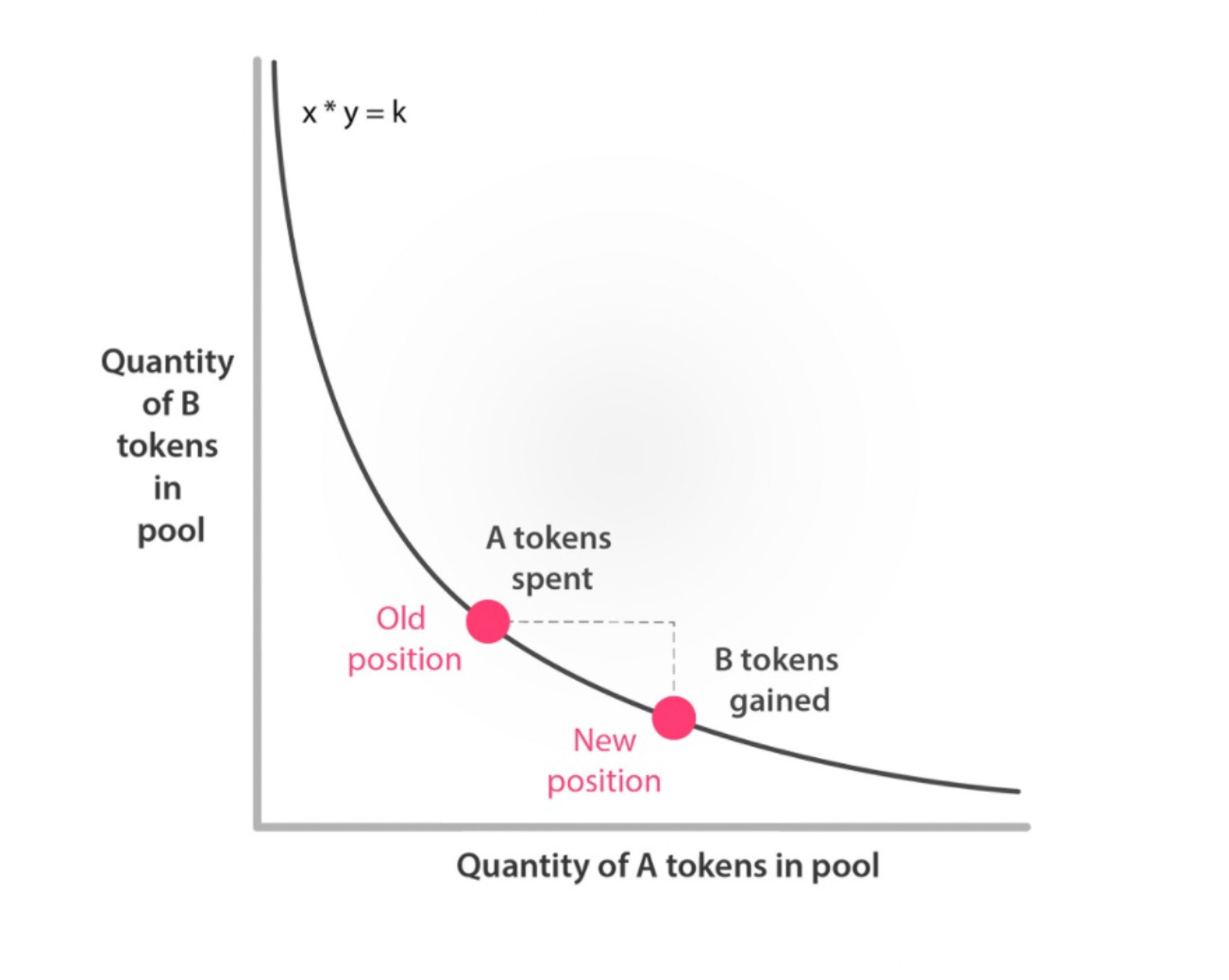

Within a single pool, the ratio of the assets is maintained by an automated market maker (AMM). Many popular pools like Uniswap and its clones leverage a constant product market maker that use the following formula: x * y = k, where x is the quantity of asset A, y is the quantity of asset B, and k is some constant. This ensures there is a stable ratio of one asset to another. More reading on the different types of AMMs can be found in the appendix.

To understand how this works, let us use an ETH/USDT liquidity pool as a case study. When ETH is purchased by traders, they add USDT to the pool and remove ETH from it. This causes the amount of ETH in the pool to fall, which, in turn, causes the price of ETH to increase in order to fulfill the balancing effect of x*y=k. In contrast, because more USDT has been added to the pool, the price of USDT decreases. When USDT is purchased, the reverse is the case – the price of ETH falls in the pool while the price of USDT rises.

The relationship between x and y is represented by what’s known as a bonding curve:

The above graph is really just a representation of supply and demand. As the demand for ETH rises, the supply of ETH falls; as a result, the price of ETH rises. Similarly, since the supply of USDT rises because it is being used to buy ETH, the price of USDT falls. I encourage you to work out that example on a classic supply and demand graph for yourself!

As I mentioned earlier, anybody can provide liquidity to a liquidity pool, granted that they provide it in a specified ratio. But why should they? When someone provides liquidity, they become a liquidity provider (LP, not to be confused with limited partner) and receive LP tokens proportional to the amount of liquidity they put into the pool. When a transaction occurs, the smart contract takes a small fee (typically ~0.3%) and distributes that fee back to the LPs based on the amount of tokens they hold. This reward structure encourages individuals to provide liquidity and keep the whole system running.

A simple example:

Say there is a USDC (stablecoin, so price = $1) / ETH (price = $2000) liquidity pool

LP Alice puts in 2 ETH and $4000, and LP Bob puts in 1 ETH and $2000. Therefore, Alice has twice the amount of tokens that Bob has. Note that you have to put in amounts according to a predefined ratio; that is, Alice couldn’t put in more ETH without also putting in proportionally more USDC.

Non-LP Participant Charlie buys 1 ETH. 0.3% of 1 ETH is 0.003 ETH, or $6. Alice earns 0.002 ETH ($4), and Bob earns 0.001 ETH ($2).

Note that the process of providing liquidity and earning rewards is very similar to staking, which I covered earlier.

Coming Back to Decentralized Exchanges

Decentralized exchanges (DEXs) leverage liquidity pools and AMMs to facilitate transactions. In fact, a DEX is really just a collection of liquidity pools that use a shared set of smart contracts under one “brand.” In addition, unlike centralized exchanges, you own your crypto and therefore are also in charge of managing the private keys that access it.

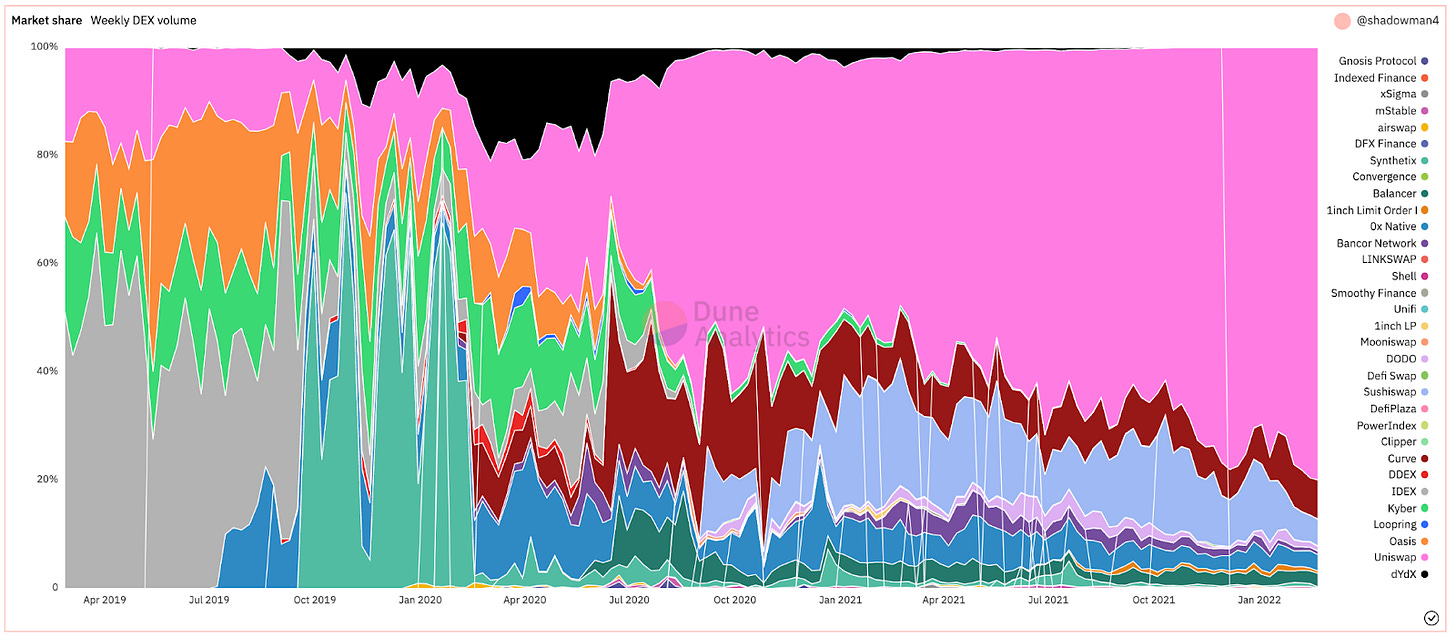

Today, Uniswap is the most popular DEX with $7.53B TVL as of this article’s release. Uniswap captured most of the DEX market early on, holding almost 70% of market share by September 2020. In the web2 world, a product gaining this much market share could spell doom for consumers by stunting innovation and removing the freedom of choice. However, in web3, consumer data and code is typically public, which has pros and cons as I’ve discussed previously. One of the pros of this accessibility is that it’s much more difficult (or impossible) for monopolies to form in the ways we’ve become accustomed to in web2. In fact, many web3 products have bootstrapped their Minimum Viable Community using this data in what’s known as a vampire attack.

Vampire attacks are purely a crypto/Web3 phenomena. At their highest level, a vampire attack refers to a method for sucking users out of an existing platform into a competing one by offering some kind of incentive (typically tokens).

Arguably the most famous vampire attack was conducted by SushiSwap in late 2020. SushiSwap launched a nearly identical DEX by forking Uniswap code. However, SushiSwap offered exciting monetary incentives to all Uniswap users by offering a new kind of token called $SUSHI that at one point provided over 1000% APY. Just as a vampire sucks blood from a victim’s neck, SushiSwap sucked a sizable amount of liquidity and trading volume out of Uniswap overnight: almost $2B!

As a result, Uniswap responded with a token of its own ~three weeks after. Alas, as with many products born out of vampire attacks, the SushiSwap hype quickly faded after early movers captured the high economic upside, which you can read more about here.

Since then, Uniswap has again captured upwards of 70% of the DEX market. Even though Uniswap is yet again the undisputed ruler of DEXs, the fact that Sushiwap forced them to innovate and quickly launch their own token is precisely why web3 can drive better results for consumers.

If the concept of vampire attacks sounds familiar, it's because they’re a common theme throughout Coinsights articles and more generally in the web3 world. For example, I covered $SOS in late 2021, which was created from a vampire attack on OpenSea. As a developer, the existence of vampire attacks is both exciting and frightening. On one hand, vampire attacks allow developers to quickly bootstrap communities without being beholden to incumbents. However, once developers actually develop a community, they must work tirelessly to maintain their moat.

The Tradeoffs

So you may be thinking, which type of exchange should I be using?

The answer is an extremely unsatisfying “it depends.” Like so many other facets of web3, there’s a tradeoff between convenience and ownership. For many people, using centralized exchanges is a perfectly good way to participate in the ever growing web3 world while still feeling adequate ownership over their crypto. However, DEXs offer greater ownership and economic upside for those who favor autonomy. If you’re curious to learn more about how to provide liquidity on Uniswap, check out this guide!

In the long run, I expect decentralized exchanges to keep eating into the market share of centralized exchanges.

Decentralized exchanges’ lower fees and other incentives will attract new users over more traditional exchanges like Binance and Coinbase. Furthermore, as we’ve seen with Uniswap and its clones, decentralized exchanges are forced to constantly innovate to keep market share. This by itself is why I’m most excited about web3: the consumer can benefit from the open nature of the blockchain, privacy concerns notwithstanding. Never before has it been so easy for us to earn ownership and influence the products we interact with daily. Onwards!

Further reading

For anyone curious to learn more, I’m going to start including a section of additional reading that dives deeper into the technical concepts in each article. I’d love to talk about these topics in the Coinsights Discord!

Downsides of constant product market making

Other popular DEXs: Curve, Bancor

Follow Shekar on Twitter @ShekarRamaswamy and check out the Coinsights Discord here!

I’m Roshan Chandna (Co-founder at The Takeoff). Senior at Washington University in St. Louis. Prev. Venture Capital Intern at Floodgate Fund)

I’m on Twitter @RoshanChandna 👋. Be sure to also check out The Takeoff on Twitter :)