Reid and Chamath on angel investing, LOTS of great tweets, Dan Ariely and Gigi Levy-Weiss on behavioral economics in startups, and more.

Weekend reads. And listens. And some funny Tweets.

Happy Friday everyone 👋!

Welcome to the December 4th Edition of What We’ve Been Following, our newsletter highlighting some of the newsletters, podcasts, blog posts, tweets, startup news, and more that our Team found interesting over the past few weeks. Due to Thanksgiving, this week’s WWBF highlights content from the past three(!) weeks.

If you missed the last Edition of What We’ve Been Following, published on November 15 and written by Roshan, be sure to check it out, here.

We’ve released a bunch of awesome interviews recently. If you haven’t already, you should check them out:

Sam Altman (CEO of OpenAI) (podcast)

Henrique Dubugras (Founder & Co-CEO of Brex) (newsletter)

As always, you can find us on Twitter @_TheTakeoff.

(Today’s What We’ve Been Following newsletter is written by Michael.)

Quick rundown of today’s newsletter:

3 Podcasts9 Tweets

1 Book

2 Articles, Newsletters, Blog Posts, Etc.

IPO News (a new section!!)

4 ‘More”

6 pieces of additional content to check out if you desire :)

Podcasts 🎙

Reid Hoffman and Chamath Palihapitiya on Angel Investing and The Future of Venture on Venture Stories. (Listen time: 39 min). This episode is phenomenal. Reid and Chamath discuss SPACs v. IPOs, issues with venture, and much, much more. The episode is a recording of a conversation Reid and Chamath had with Erik and a group of angel investors. Toward the end of the episode, Erik fields questions from a bunch of incredible angels (including several founders you’ll probably recognize). It’s super informative and definitely worth the listen.

Naval: Groups Search for Consensus, Individuals Search for Truth. (Listen time: 2 min). I spent a few hours last week listening to a bunch of Naval’s podcasts. This remarkable short episode dives in on how and why groups search for consensus, while individuals search for truth. My biggest takeaway: “School does a lot of things, education is only one tiny piece of it.” This makes you rethink the place of early education and schooling in our society. Is it to educate our youth? Is it to babysitting them? Is it something entirely different?

Turner Novak on Venture Stories. (Listen time: 36 min). Turner joined Erik Torenberg to discuss consumer social and gaming. They dive in on a lot of interesting topics / companies, including Turner’s incredible deep-dive on Pinduoduo. If you are interested in learning more about the current and future state of consumer social and gaming, I highly recommend giving this episode a listen.

Other good listens: Mike Duboe | The Rise of Headless Commerce (Greymatter), Okta’s Todd McKinnon on Invest Like the Best, Slack’s Stewart Butterfield on 20VC, Benchmark’s Sarah Tavel on 20VC.

Tweets 🐦

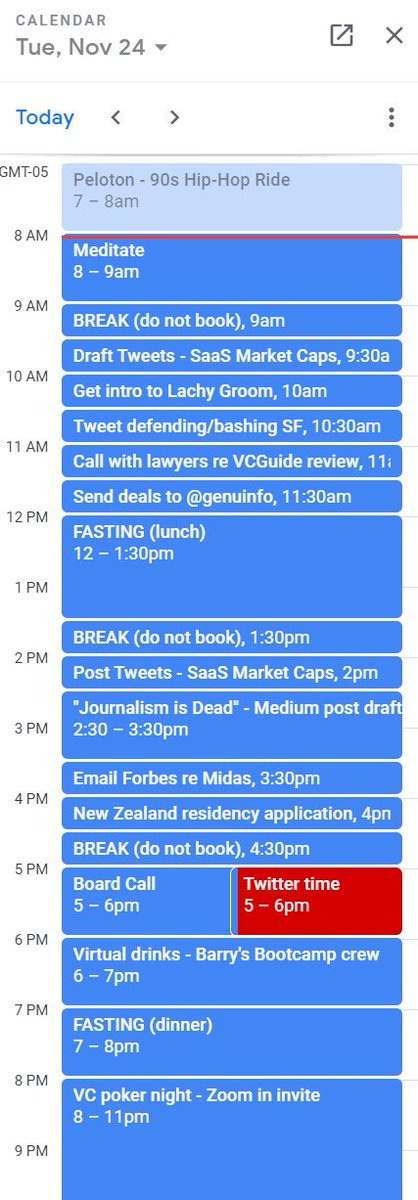

I’ve spent a lot of time on Twitter recently. Probably too much. But, hey, who’s counting?

Inspiring. From the projects in Brazil to being CTO of a Y Combinator company (Facio), learn more about Márcio Dos Santos’ story. You’ll be glad you did!

How Plaid Hires. Plaid co-founder & CEO Zach Perret on how Plaid evaluates potential hires

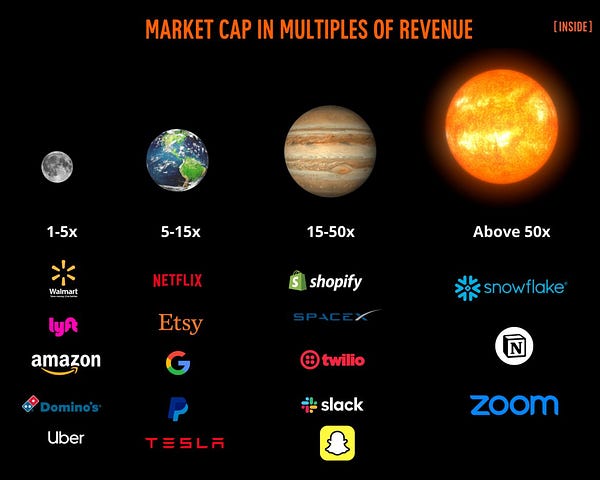

Revenue v. Market Cap. I came across this awesome graphic of Revenue v. Market Cap a few weeks ago.

This made me laugh.

LOL! So a 12-year-old investor (Young Investor 2) took over Twitter two weeks ago. If you haven’t already watched any of his YouTube videos offering investment advice, I highly recommend doing so.

Want to live longer? Jack Altman (Founder & CEO of Lattice) says that Lifespan: Why We Age — and Why We Don’t Have To claims the four best things we can do to live longer are: intermittent fasting, eating less meat, high-intensity exercise, and exposing ourselves to the cold (WAIT… WHAT?). This Tweet led me to try going vegetarian — it lasted two days!

Yes, yes it does Schlaf!

Good investors v. Bad investors.

The value of entrepreneurship classes in college?

Books 📕

Little Red Books of Selling by Jeffrey Gitomer. Shoutout Henrique Dubugras for the recommendation in your interview with Roshan! Key takeaways:

Focus on why people buy, not how to sell.

If people like you, they may buy.

“Stick at it until you win. Don’t quit on the 10-yard line.”

Don’t blame, just do.

Articles, Newsletters, Blog Posts, Etc. 📝

The Irrational Truths of User Behavior, with Dan Ariely (Gigi Levy-Weiss at NFX). I’m a Dan Ariely and behavioral economics fanboy, so it was awesome to see his thoughts and advice as it relates behavioral economics to startups. I highly recommend checking out the post and/or listening to the podcast of Gigi and Dan’s conversation (podcast), but if you just want the quick rundown, here are a few things that stood out:

Trust: Lemonade built trust with customers by adding a third player (a charity) to the game.

Understanding Consumer Habits: It is critical for founders to understand how consumers behave (and not get blocked by what they, as a founder, expect from consumers).

Fairness and motivation: Building “fairness” into pricing is often more important than whether or not the pricing is fully rational. Make prices fair! Building motivation into products can get consumers to behave in certain ways (this relates to the idea of gamification that Rahul Vohra at Superhuman talks about a lot).

The All Raise Reading List. All Raise shared a list of top Fall 2020 reads from a group of incredible female founders, investors, and operators. My personal favorite books from the List: Grit (by Angela Duckworth) and Outliers (by Malcolm Gladwell).

IPO News

Yes. We are giving this its own section. A number of notable companies have filed for IPOs in the past few weeks. Roshan already discussed DoorDash’s filing and S-1 in the last WWBF newsletter. Since then, other notable companies such as Airbnb, Affirm, and Roblox have all filed to go public, too. Get the bell ready — IPO “season” is heating up! A lot of this year’s big IPOs have come in waves. Snowflake, JFrog, Unity, and Sumo Logic all went public in mid-September. Palantir and Asana then followed two weeks later. Read more about the IPO’s and S-1’s for Roblox, Airbnb, and Affirm, below:

More… 💡

Octahedron Capital’s Q3 learnings.

The S-1 Club. Mario Gabriele and some others recently launched The S-1 Club on ProductHunt. It’s a new newsletter that will “bring the sharpest investors and operators together to dissect companies preparing for listing. All so you can be in the know, before the IPO.” The S-1 Club will follow a similar format to some of the deep dives Mario did on Palantir, Asana, Snowflake, Lemonade, and others before these companies went public (we shared a few of these in previous WWBF newsletters!). Here’s The S-1 Club’s post on Airbnb. It’s good! Really good.

Contrary Capital’s How to Start a Startup guide. Contrary recently launched a guide highlighting how to launch a startup on 35+ college campuses. The guide gives specific information and resources for students looking to launch companies at various schools. If you’re a student looking to launch a business, be sure to check if your school is on the guide!

Wellory raises $4.5M for its ‘anti-diet’ nutrition app. I’m super excited about the future of Wellory! Congrats to Emily Hochman and the team on the new funding! Also, shoutout to Jordan Odinsky and Ground Up for participating in the round :) Emily was also named to Forbes 30 Under 30 for Consumer Technology earlier this week — a busy and exciting week for her!

Other things to check out: Forbes 30 Under 30 (2021), Job Tracker by Teal.

That’s all for today’s Edition of What We’ve Been Following!

Thanks for being a part of The Takeoff fam! Help us grow and expand our impact by sharing The Takeoff.

We have some amazing interviews lined up to be released in the coming weeks! Let us know your feedback by shooting us a tweet or DM on Twitter (@_TheTakeoff).

If you found this post valuable, share it with your friends, and subscribe if you haven’t already.